Variable expenses include costs that can change from month to month, like food, gas, or entertainment, depending on your behavior. Manage your fixed and variable expensesĬertain expenses, such as your cell phone or car insurance bill, typically stay the same every month. Bonus: If you can do that, you’ll also reduce the amount of interest you’ll have to pay while in school or after you graduate.

Once you’ve set a budget, keep track of it. Once you hit the limit in a given category by running through money in its envelope-whether literal or digital-you can’t spend any more in that category until the next budget period begins. You can also go with the envelope system, which involves setting aside a limited amount of money for each spending category.

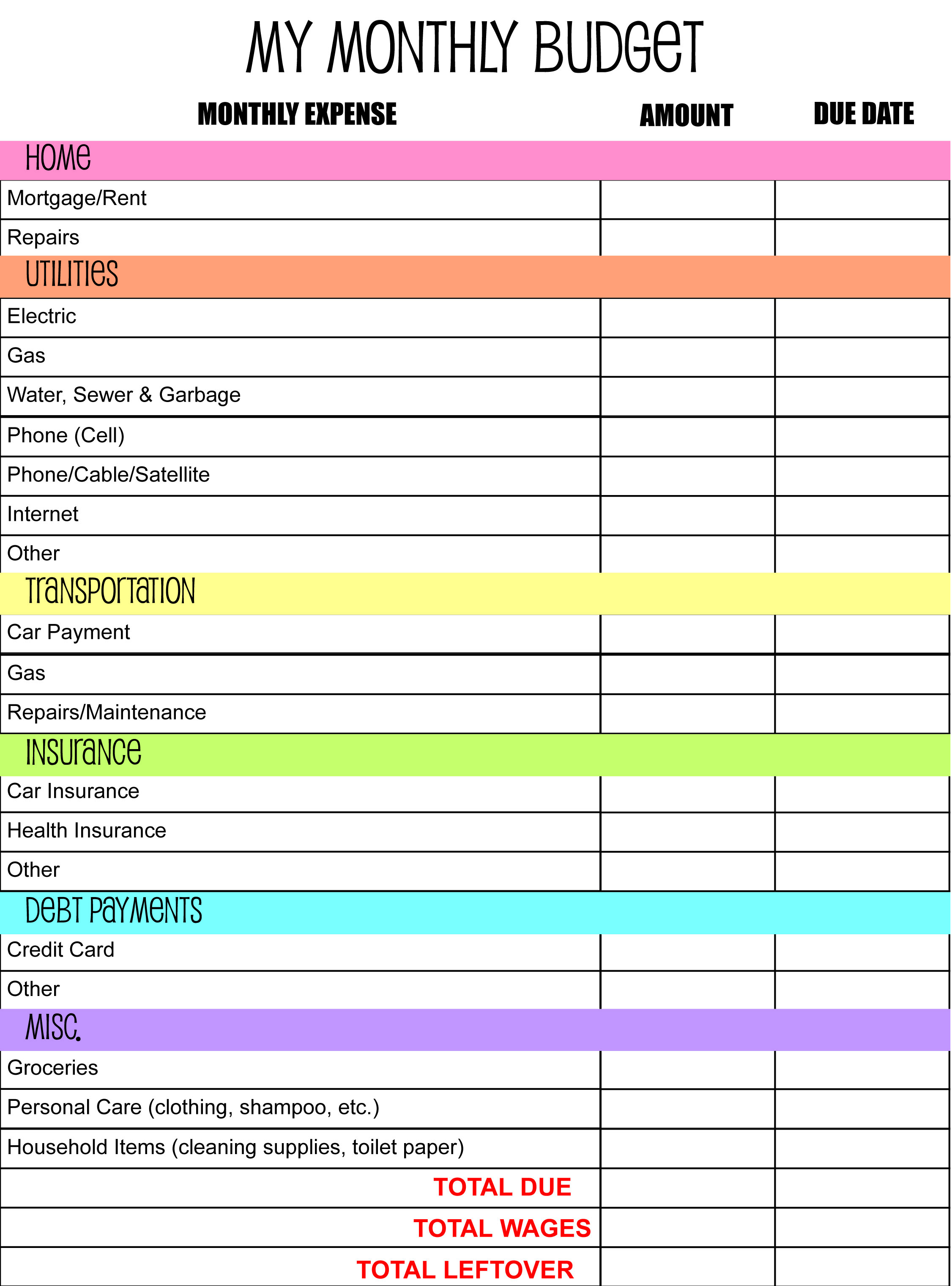

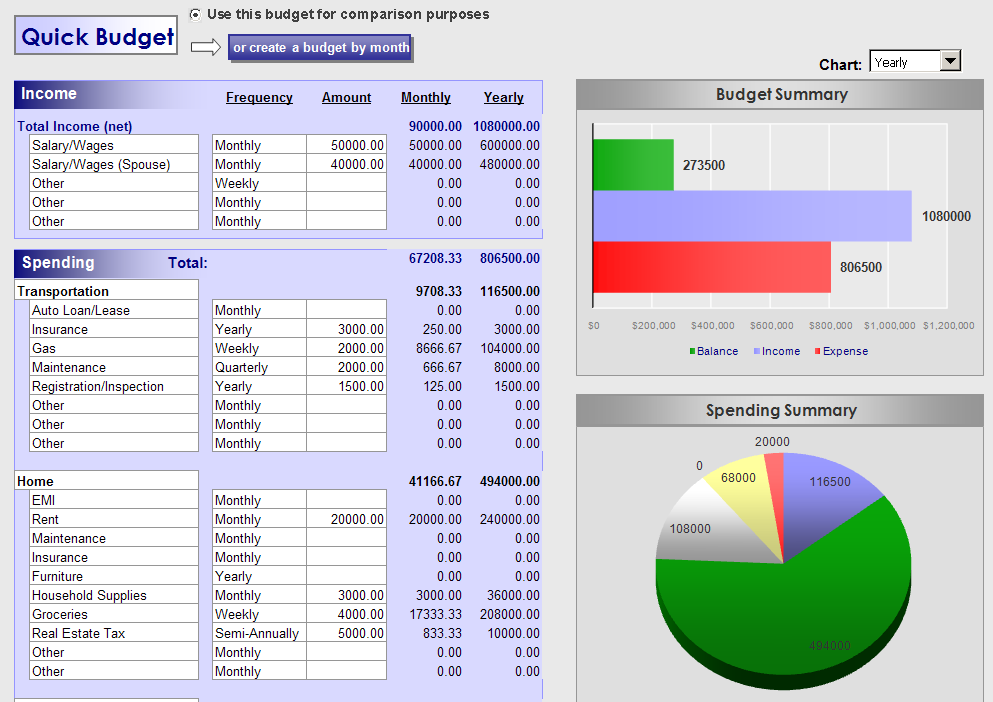

You could try the 50/30/20 rule, which allocates 50% of your money toward needs (food, textbooks, tuition) 30% toward wants (entertainment, clothing) and 20% toward savings. There are different budgeting styles, and Waters notes that one might fit your specific situation better than another. (Refer to the list of expenses you created when assessing your expenses.) Then decide how much you must spend for each and assign a dollar amount or percentage to that category. Your budget should contain categories for all your major spending groups.

#BUDGET MAKER ONLINE HOW TO#

Here’s how to budget as a college student: 1. Making and following a college student budget is the best way to ensure you have enough money to pay for the things you need while still having some money left over for the things you want. Check out these tips to help you make money as a college student. If you’ve gotten this far and you already realize that your expenses weigh in heavier than your income, consider ways you could start giving your income a leg up. The point is to add up everything, Waters says. Transportation (airfare, bus tickets, car insurance, gas).Entertainment (movies, fun with friends, streaming services).You should account for every dollar you’ve spent, Waters says, separating expenses into common categories such as:

#BUDGET MAKER ONLINE PLUS#

To do that, refer to your debit and/or credit card statements, plus any record of money sent through payment apps. Waters recommends looking back at three months’ worth of your expenses. Next, figure out how much you’re spending each month. That includes money from a part-time job, financial aid, stipends, grants, loans, or a monthly allowance from your parents. How should students pay for monthly expenses? Start by writing down all the sources of after-tax money you get each month, Waters says. You can use anything from a simple spreadsheet to a budgeting app to track your income and expenses. Assess your income and expensesĪs you begin building your college student budget, you first need to figure out how much money you have coming in and how much you have going out. Whatever financial issue is giving you trouble, Katie Waters, CFP®, founder of a financial planning firm, has tips for how to set yourself up for success. Need to make sure you have enough for textbooks, rent, food-and some left over for a little fun? Want to spend a semester abroad? Creating a college student budget can help with these goals and more. When done right, a budget can help you limit debt, build some savings, and accomplish your goals. But this transition also comes with different financial realities-and the need to develop new skills around spending and saving money.Īlong with navigating your new campus and sharpening your study skills, there’s another key lesson to learn: how to create a college student budget. College is an exciting time: You’re surrounded by new people, new opportunities, and a chance to dive into the next chapter of your academic career.

0 kommentar(er)

0 kommentar(er)